By Steve Whitehill, Anchor Business Brokers

To this point we have covered how to determine the “Cash” compensation portion of payroll for the Schedule A worksheet of the loan Forgiveness application (SBA Form 3508). The next topic is the Non-Cash Compensation & Compensation to Owner.

Non-Cash Compensation

First, we will be discussing PPP Schedule A Lines 6, 7, 8 Non-Cash Compensation, which are the forgivable non-cash payroll costs incurred by the employer during the cover period or the alternative cover period. These are items like Health Care Expenses, Retirement Contributions & State Unemployment Taxes and Other State Employer Payroll Taxes. Do not include any amount withheld from the employees. To be clear if you didn’t pay them you can’t be forgiven for it.

With respected health insurance and state payroll taxes the concept here is similar to cash compensation. Thus, these expenses must be incurred during the eight-week period or on or before the payroll date.

Below summerizes what goes on lines 6, 7 & 8.

- Line 6: Health Care Expenses

- Employer contributions for employee health insurance,

- Employer contributions to self-insured health plan,

- Employer-sponsored group health plan,

- Excluding any pre-tax or after-tax contributions by employees.

- Line 7: Retirement Contributions

- Employer contributions to employee retirement plans,

- Excluding any pre-tax or after-tax contributions by employees.

- Line 8: State Unemployment Taxes and Other State Employer Payroll Taxes

- For employer state and local taxes assessed on employee compensation (e.g., state unemployment insurance tax);

- Excluding any taxes withheld from employee earnings.

Contributions to employer-sponsored retirement plans including profit sharing plans, for example, are eligible for forgiveness. However, they are limited to the amount paid or incurred during the cover period. They do not include any amounts withheld or not paid to the employees. For retirement plans that are not processed through payroll or for which payments are made at the end of the year or after year-end, it is recommended that the employer contact their retirement specialist and/or actuary to obtain relevant figures and actually transfer the funds into the plan during the cover period. One other note is that for self-employed individuals, schedule C who do not have employees, the is non-cash payroll costs or expenses are part of the $15,385 cap.

Compensation to Owners

Next. we are going to cover compensation to owners, Schedule A Line 9. This is

- Cash compensation paid to owners (owner-employees, a self-employed individual, or general partners).

- This amount is capped at the lesser of $15,385 (the eight-week equivalent of $100,000 per year) for each individual or the eight-week equivalent of their applicable compensation in 2019, whichever is lower.

NOTE: The amount reported on Line 9 should not be included in PPP Schedule A Worksheet, in either Table 1 or 2.

While there is still a question of what constitutes an owner for the purposes of the application, for the moment we will take it at face values.

The question as to why was this done and why separate owners’ compensation on a separate line? The idea here is to prevent the owners from increasing their compensation levels during the covered period. As compared to 2019 and then have it forgiven. With respect to non-cash compensation such as retirement, healthcare, etc. it would be caped at $15,385. However, for owners of S & C Corps, as opposed to Schedule C, non-cash compensation maybe included on line 6 thru 8 Schedule A and thus forgivable in addition to the cash compensation.

Go back to the Case Study, John, the Owner, increase his compensation to $150,000. The Table below show how the above rules impact the amount of the loan forgiveness.

| Non-Cash Comp and Comp to Owners | ||||||

| Employee | Annual Salary for covered period | Actual Cash Compensation for covered period (capped at $15,385) | Health Insurance | Annual Salary for 2019 | 8 week equivalent of 2019 Compensation | |

| John (owner) | 150,000 | 15,385 | 3,141 | 50,000 | 7,692 | |

| PPP Schedule A, Line 9: Total amount paid to owner-employees | ||||||

| Lower of : | actual compensation for covered period or | |||||

| 8 week equivalent of compensation in 2019 | 7,692 | |||||

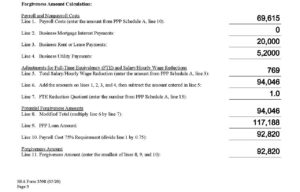

We now have enough information to Complete Schedule A which is presented below. Just to go through it, lines 1 thru 3 come from table 1. Line 4 and 5 come from table 2 and line 6 is the total employee health insurance paid during the cover period. It is worth noting that this includes the owner’s health insurance in this case. Into line 9 enter the owner-employee compensation. For line 10 we just add up all the payroll cost (1 through 9). Then line 11 or 12 are for businesses that are subject to FTE reduction. In this case the Safe Harbor kicks-in once they brought back Carla.

Non-Payroll Costs or Expenses (or do you with the extra two weeks of Cash the you got form the PPP loan)

Loan Forgiveness Application Non-payroll costs are lines 2, 3 and 4 on the actual loan forgiveness application itself. What goes into each line can be found below.

- Line 2: Mortgage Interest Payments

- Business mortgage interest payments during the Covered Period for any business mortgage obligation on real or personal property incurred before February 15, 2020. Do not include prepayments.

- Line 3: Rent Payments

- Business rent or lease payments for real or personal property during the Covered Period, pursuant to lease agreements in force before February 15, 2020.

- Line 4: Utility Payments

- Business utility payments during the Covered Period, for business utilities for which service began before February 15, 2020.

- Includes electricity, gas, water, transportation, telephone, or internet access

To be an eligible non-payroll cost must be paid or incurred during the Covered Period and paid on or before the next regular billing date. For these expenses you cannot use the alternative covered payroll period. For an example if you received your PPP loan on May 1 and you paid your May’s rent on April 30th this expense would be eligible for forgiveness since the eligible expense occurred during the covered period. Another example, if the covered period ended on June 30 but you paid your June rent on July first, then that payment would also be eligible. Remember that you might have to do some prorating based on what period the expense covers vs the cover period. Also, the underlying contracts for these expenses must have been place before Feb 15, 2020. In addition, for mortgages only the interest is forgivable not the principle. No interest prepayments are allowed.

There are some nuances as to what expenses qualify. One is that lease payments for rent or cars are eligible for forgiveness.

We now have sufficient information to complete the actual loan forgiveness application (page 3). What follows is based on the case study.

Required Documentation

Payroll documentation verifying both the cash and non-cash compensation payments for the Covered Period (or Alternative Payroll Covered Period) consists of the following:

- Bank account statements or third-party payroll service provider reports documenting the amount of cash compensation paid to employees.

- Tax forms (or equivalent third-party payroll service provider reports)

- Payroll tax filings reported, or that will be reported, to the IRS (typically, Form 941)

- State quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported, to the relevant state.

- Payment receipts, cancelled checks, or account statements documenting the amount of any employer contributions to employee health insurance and retirement plans that the Borrower included in the forgiveness amount.

- Third party payroll provider reports.

FTE documentation showing the following information:

- The average number of FTE employees on payroll per month employed by the borrower between February 15, 2019 and June 30, 2019

- The average number of FTE employees on payroll per month employed by the borrower between January 1, 2020 and February 29, 2020; or

- In the case of a seasonal employer, the average number of FTE employees on payroll per month employed by the borrower between February 15, 2019 and June 30, 2019; between January 1, 2020 and February 29, 2020; or any consecutive twelve-week period between May 1, 2019 and September 15, 2019.

- Third party payroll provider reports.

Non-payroll documentation verifying existence of the obligations/services prior to February 15, 2020 and eligible payments from the Covered Period through one month after the end of the Covered Period:

- Business mortgage interest payments: copy of lender amortization schedule and receipts or cancelled checks verifying eligible verifying interest amounts and eligible payments.

- Business rent or lease payments: copy of current lease agreement and receipts or cancelled checks verifying eligible payments.

- Business utility payments: copy of invoices from February 2020 and those paid during the Covered Period and receipts, cancelled checks, or account statements verifying those eligible payments.

Areas of Uncertainty

- When is the Loan Forgiveness Application (Form 3508) due to the lender?

- If an employee left or was terminated during or after Q1 2020, and the business hired a replacement employee, would any reductions apply related to the former employee?

- What is an “owner-employee”?

- Do retirement benefits include only amounts attributable to the Covered Period?

- Are bonuses and raises paid to non-owner employees during the Covered Period or the Alternative Payroll Covered Period includible in the amounts eligible for forgiveness?

- Are bonuses accrued before the Covered Period but paid during the Covered Period eligible for forgiveness?

- Is interest on loans and lines of credit collateralized by inventory eligible for forgiveness?

- What happens to forgiveness if a borrower’s Covered Period ends after June 30, 2020?

As a parting thought from the last paragraph of page 10 of the application:

“All records relating to the Borrower’s PPP loan, including documentation submitted with its PPP loan application, documentation supporting the Borrower’s certifications as to the necessity of the loan request and its eligibility for a PPP loan, documentation necessary to support the Borrower’s loan forgiveness application, and documentation demonstrating the Borrower’s material compliance with PPP requirements. The Borrower must retain all such documentation in its files for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request.”

Unfortunately, the process is difficult, complicated, and unclear. Have hope, it looks like Congress will fix some of these problems or maybe that’s just another fairytale.

Please feel free to contact me, and I will try to be of help. ?