How We Calculate the Value of Your Business

We take your Seller Discretionary Earnings (SDE), also referred to as Owner Benefit, Seller Discretionary Income (SDI), Adjusted Net or Adjusted EBITDA (Earnings Before Interest Taxes Depreciation and Amortization) and multiply it by an industry ratio (SDE Multiplier), which has been developed from a database containing historical sales information for businesses like yours.

The industry ratio or SDE Multiplier changes based on the size of your business, how long your business has been established and other risk factors. Our SDE Multiplier is calculated using a continuously-updated database of prices for businesses that have sold in your industry. The selected valuation multiple eliminates outliers by representing only the middle one-third of reported transactions for an industry.

To Seller Discretionary Earnings (SDE) marketable inventory is usually added. The value of this inventory is usually the lower of historical or current acquisition cost. Our base calculation works as follows:

SDE x SDE Multiplier + Inventory = Most Probable Selling Price (MPSP) If you own the building your business is in, the valuation of the real estate is a separate calculation independent of the valuation of the business itself. The value of your real estate should be added to the MPSP in order to understand your total value.

How Can I Boost the Value of My Florida Business?

Owners of all types and sizes of businesses are interested in learning how to get top dollar for their most valuable asset. Getting a business valuation is a critical step, but only the first. Having “discovered” the value of your business, the next steps towards increasing value involve monitoring and making necessary changes to ensure growth and minimize future risk.

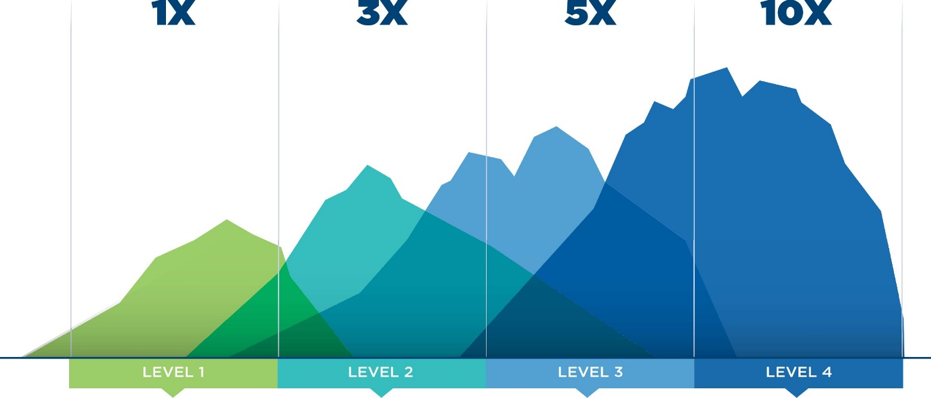

The graph from BizEquity demonstrates how the size of your business affects its value. Companies with higher revenues and earnings are worth more than their smaller counterparts. Higher earnings directly increase value at any multiple and lead to a higher valuation multiple.

This is due to many factors, including the fact that larger businesses tend to have a stronger infrastructure that will be more likely to withstand a change of ownership and support the profitability of the business into the future.

Our calculators are designed to give you an idea of what your business might be worth, which is a valuable starting point. But business valuation is an art, not a science. Valuations are subject to the appraiser’s judgment, skill and quality of methodology.

When you are ready to take the next step, contact us for a complimentary, no-obligation valuation of your business. We’ll be happy to discuss the impact of the results with you.

Disclaimer

This business valuation calculator is designed as a self-help research tool for informational uses only. All calculator results are rough estimations and should not be relied on. The calculator is not intended to provide investment advice, provide a firm business valuation, or replace an independent business appraisal provided by a qualified business valuation professional in your market or area. We strongly recommend you consult professional business advisors including Business Brokers, Business Attorneys, CPA's, Financial Advisors, Certified Business Appraisers, and Tax Advisors before making any financial or investment decisions.

This website and the material and information contained within are provided to you on an "as is" basis without any warranties of any kind. In no event shall Anchor Business Advisors Inc. be liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever with respect to this service, services, the information, and the products.